Claiming Disabled Adults As Dependents 2025

Claiming Disabled Adults As Dependents 2025 - 1,25,000 deduction for people with severe disability. Claiming Disabled Adults As Dependents 2025. There are no specific credits available for disabled dependents. Can you claim adults as dependents on your taxes?

1,25,000 deduction for people with severe disability.

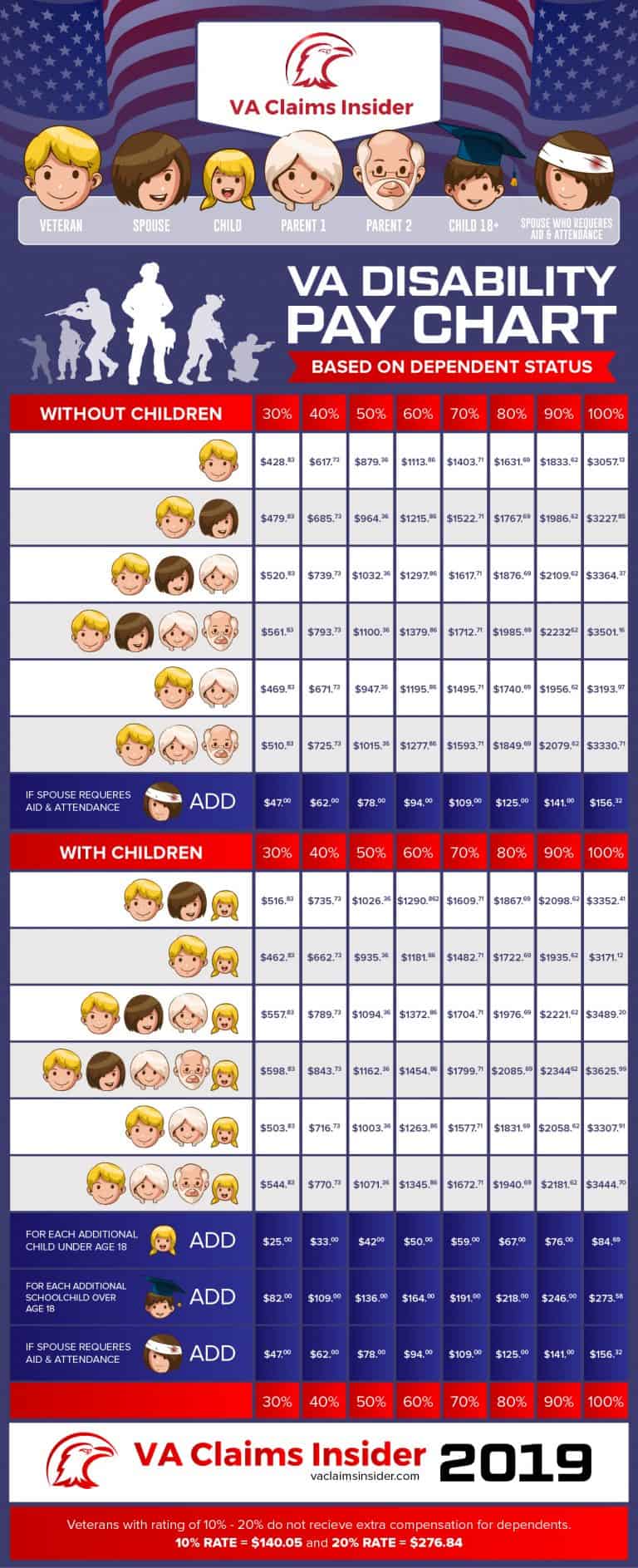

2025 VA disability pay chart based on dependent status VA Claims Insider, The adult must live with you and receive more than half of their. Can you claim adults as dependents on your taxes?

VA Benefits for Dependents of Disabled Veterans CCK Law, Can you claim an adult as a dependent? Typically, it’s the higher earner.

Several requirements must be satisfied before you claim an adult as a dependent on your tax return. 1,25,000 deduction for people with severe disability.

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, Approved applicants who are 18 years and older (on the last day of the year) may claim the base disability amount. Common mistakes to avoid when claiming.

‘We are people too’, disabled adults tell government after social care, If so, several federal tax breaks—including the earned income tax credit (eitc) and the child tax credit. Claiming disabled children or adults as dependents.

A StepByStep Guide to Claiming Disabled Adult Child Benefits, Updated and reviewed in 2025 by ken shulman, of counsel at day pitney, llp. Claiming disabled children or adults as dependents.

The irs doesn’t offer any specific credits for disabled dependents.

/claiming-adult-dependent-tax-rules-4129176-83b1f0c58bf94edca0609dacc7e750fe.gif)

1,25,000 deduction for people with severe disability.

Caregiver For Disabled Adults Optimum Personal Care, Requirements to claim deductions under section 80u. Watch this video and find out what they are.

Resident individuals and huf can claim deductions for the disabled dependent.